German insurer Talanx AG is seeking to raise at least $100 million through catastrophe bonds focused on parametric earthquake coverage in Latin America, particularly targeting Chile and neighboring regions. The company is partnering with Hannover Re to access the capital markets for this purpose, providing essential reinsurance solutions in response to seismic threats.

Talanx AG, a prominent German insurance firm, is venturing into the catastrophe bond market with an objective to secure a minimum of $100 million in parametric earthquake coverage specifically for Latin America. While the primary focus of this initiative lies in Chile, the arrangement is designed to encompass earthquake events in adjacent countries as well. Talanx is collaborating with its reinsurance division, Hannover Re, to facilitate access to capital markets for this reinsurance coverage, with Hannover Re acting as the direct front for Maschpark Re Ltd., based in Bermuda, eventually passing the coverage to its parent company.

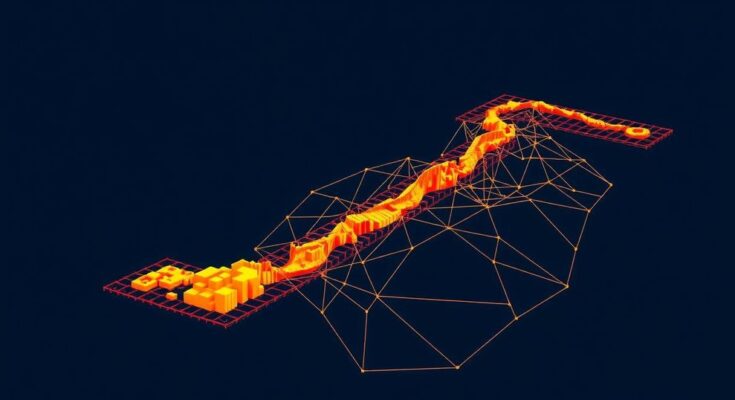

In the face of escalating seismic risks in Latin America, particularly in the South American region, insurance companies are increasingly seeking innovative solutions to mitigate potential financial burdens from natural disasters. Catastrophe bonds provide a form of insurance linked to the occurrence of specific disasters, such as earthquakes. The surge in popularity of such financial instruments allows insurers like Talanx to offer protection while also obtaining necessary capital for potential claims resulting from catastrophic events. This strategic approach highlights the ongoing evolution of risk management within the insurance industry.

Talanx AG’s recent initiative to enter the catastrophe bond market highlights an adaptive approach to risk management amid increasing earthquake risks in Latin America. By targeting a minimum of $100 million in coverage, the firm is leveraging its reinsurance capabilities through Hannover Re to navigate capital markets effectively. This move not only reflects the growing recognition of the necessity for innovative safety nets in the insurance sector but also underscores the importance of regional considerations in disaster preparedness efforts.

Original Source: www.businessinsurance.com