Analysts are optimistic about ReconAfrica’s exploration progress at the Naingopo well in Namibia, where drilling approaches completion. The well is estimated to hold substantial resources, with the potential for significant stock appreciation if hydrocarbons are confirmed. The company’s upcoming seismic survey also marks a critical step forward. Current buy ratings by prominent securities firms reinforce positive market sentiments.

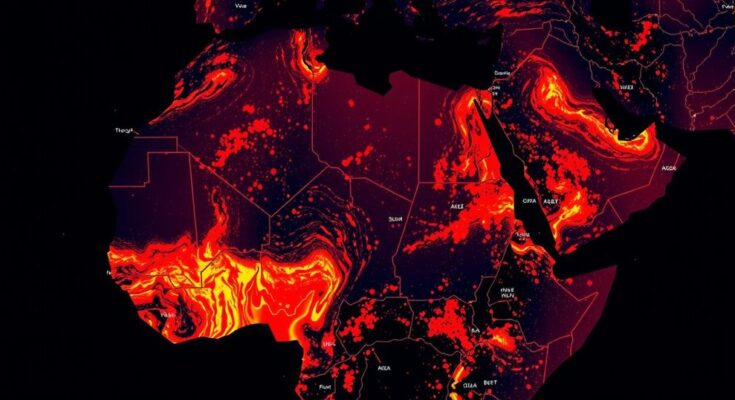

Analysts have expressed optimism regarding Reconnaissance Energy Africa Ltd (TSX-V:RECO, OTCQX:RECAF) following recent developments in its exploration program in Namibia and Botswana. Significant progress has been made at the Naingopo exploration well in the PEL 73 block, which is currently being drilled to a target depth of 3,800 meters. Despite some delays stemming from equipment adjustments, the well has reached a depth of 3,500 meters, with anticipated completion of drilling operations in the near future. If the drilling team successfully demonstrates the presence of hydrocarbons and establishes the economic viability of these resources, analysts believe that the company’s stock could see considerable appreciation. “Should the team be successful in proving the presence of hydrocarbons and the economic viability of its resource, we believe the stock could be worth multiples of its current valuation,” stated the analysts at Haywood Securities. The Naingopo well has been estimated to contain unrisked resources of approximately 309 million barrels of oil and 1.6 trillion cubic feet of natural gas. In addition, should a natural gas discovery occur, the estimated unrisked prospective resources could reach 937 billion cubic feet (Bcf), with a net of 656 Bcf according to Research Capital Corporation. Looking ahead, ReconAfrica is poised to execute Namibia’s inaugural onshore 3D seismic survey, which will encompass 500 kilometers of the Kavango Rift Basin in mid-2025, marking a crucial development in its exploration strategy. Results from the Naingopo drilling are expected shortly, further fueling analyst positivity towards the company’s future prospects. Research Capital Corporation has maintained a Speculative Buy rating on the stock, with a target price of C$2.30, reflecting the high-risk, high-reward nature of the ongoing exploration efforts. Meanwhile, Haywood Securities holds a Buy rating, setting a target price of C$2.10 per share. On Wednesday, shares of ReconAfrica were trading at approximately C$0.97 in Toronto.

Reconnaissance Energy Africa Ltd is focused on exploration activities in Namibia and Botswana, particularly through its Naingopo project located in the PEL 73 block of Namibia. The exploration well is a key focal point for the company and has the potential to significantly impact its market value based on the presence of hydrocarbons. Analysts closely monitor the drilling progress and upcoming seismic surveys to gauge the viability and profitability of the resources in this region. The company has garnered attention for its ambitious exploration goals and the potential for substantial oil and gas discoveries, thereby positioning itself in a critical phase of growth within the energy sector.

In conclusion, the ongoing drilling operations at ReconAfrica’s Naingopo well present a significant opportunity for the company, with analysts maintaining a positive outlook based on its potential resource discoveries. The upcoming seismic survey and favorable estimates of hydrocarbons will likely play a pivotal role in the company’s valuation and market performance. The exploration efforts in Namibia, coupled with optimistic analyst ratings, suggest a promising future for ReconAfrica in the burgeoning energy market.

Original Source: www.proactiveinvestors.com