Kenya is negotiating a $1.5 billion commercial loan with the UAE, featuring an 8.25% interest rate and a seven-year term. Finance Minister John Mbadi emphasizes the loan’s advantages over previous borrowing options, seeking to alleviate local borrowing pressures and boost economic growth following civil unrest and delayed IMF funding. Negotiations regarding risk management continue with the IMF.

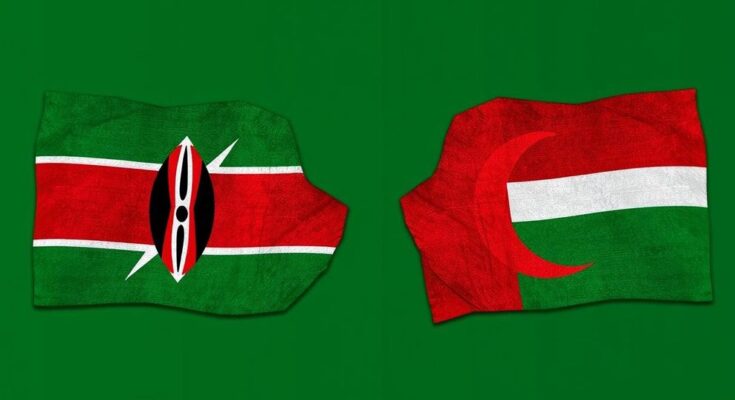

NAIROBI – The Government of Kenya is currently engaged in negotiations with the United Arab Emirates (UAE) for a commercial loan amounting to $1.5 billion. According to Finance Minister John Mbadi, this loan is proposed to carry an interest rate of 8.25% and a tenor of seven years. The initiative to secure this financing aligns with Kenya’s objective of diversifying its funding sources, particularly in light of recent civil unrest that necessitated a reevaluation of tax policies and delays in anticipated financial assistance from the International Monetary Fund (IMF). In reference to previous borrowing costs, Minister Mbadi noted, “This loan is cheaper than the Eurobond we borrowed at 10.7%,” referring to a $1.5 billion dollar-denominated bond issued earlier this year to address a maturing Eurobond obligation. It is important to highlight that the Kenyan government continues to communicate with the IMF, which has raised concerns regarding the potential risks associated with taking on a dollar-denominated loan from the UAE. Mbadi stated, “There are issues to be discussed, including with the IMF, which had expressed some reservations, because we are talking about this being an external loan and is dollar denominated, it may expose us to additional risk.” Despite these concerns, the Kenyan government maintains that the proposed loan represents a more favorable option compared to alternative financing avenues such as Eurobonds. The local authorities are presently in the process of identifying a transaction adviser to further this initiative. For the current financial year, the government has set a target for foreign borrowing at 168 billion shillings (approximately $1.31 billion). Should the negotiations with the UAE come to fruition, it will yield around 195 billion shillings, facilitating a reduction in local borrowing requirements. The administration under President William Ruto has placed a high priority on decreasing the existing high lending rates to bolster business operations and stimulate economic growth. Recently, the central bank lowered its benchmark lending rate by 75 basis points to 12%, which remains above the target of 10% or lower, according to Minister Mbadi. Under President Ruto’s leadership since September 2022, Kenya has strengthened its diplomatic and economic relations with the UAE, which has included significant agreements in oil supply arrangements. The UAE is notably recognized for its previous financial support to Ethiopia and its investment initiatives in Egypt, reflecting a broader trend of Gulf nations providing financial assistance to African countries.

The article highlights Kenya’s current efforts to secure a substantial loan from the UAE as part of its strategy to reform and stabilize the economy amid domestic challenges. The context includes prior civil unrest that led to tax policy reconsiderations, delayed IMF funding, and the government’s ongoing discussions to navigate financial options that minimize risk while promoting economic growth.

In conclusion, Kenya’s discussions with the UAE for a $1.5 billion loan at a lower interest rate than previous Eurobond options reflect a strategic move to strengthen its financial positioning. As the government seeks to alleviate local borrowing pressures and stimulate economic recovery, negotiations remain ongoing, particularly with the IMF regarding potential risks. The outcomes of these discussions could significantly impact fiscal policy and economic relations with international partners.

Original Source: www.zawya.com