A recent ASCOR study reveals that wealthy countries are failing to meet climate goals, with inconclusive trends in emission reduction efforts. With 2024 expected to be the hottest year, urgent action is required. Investors call for credible governmental commitments to sustainability, while only a minority of countries have established legal frameworks for climate action. Financial contributions from wealthy nations to global climate funding remain alarmingly low.

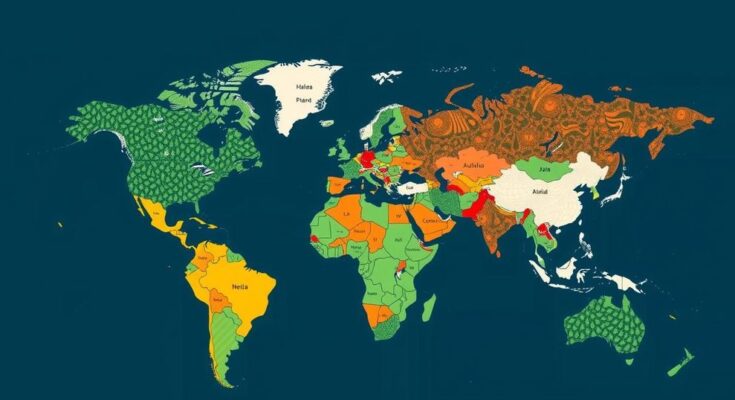

Recent evaluations reveal that affluent nations are not adequately addressing climate change, raising concerns among investors in government debt. The Assessing Sovereign Climate-related Opportunities and Risks Project indicates that the emission reduction pledges of these countries do not align with the critical 1.5 degrees Celsius target. A comprehensive review of 70 nations highlights the absence of significant trends indicating responsibility among wealthy states in combating climate issues, casting doubt on their commitments to sustainability.

The urgency for action intensifies as 2024 is poised to be the hottest year recorded, with global temperatures projected to rise to 1.5 degrees Celsius above pre-industrial levels, as reported by the World Meteorological Organization. Victoria Barron, Chief Sustainability Officer at GIB Asset Management and co-chair of ASCOR, emphasized the need for “more credible action by governments” to drive meaningful investments, urging policymakers to establish robust climate and energy policies.

Despite the heightened investor concern, financial markets often fail to consider the full implications of climate risks. Researchers are investigating a phenomenon termed the “climate-sovereign debt doom loop,” which aims to assess how climate change may exacerbate national debt issues for various countries. Concurrent legal challenges are emerging against governments accused of neglecting citizen safety during extreme weather events, with International Court of Justice hearings on the horizon.

The situation is dire in the United States, where the anticipated actions of President-elect Donald Trump, including potential withdrawal from the Paris Agreement, threaten climate commitments. European policymakers face significant challenges from corporate resistance to sustainability initiatives. Nonetheless, some nations, namely Costa Rica and Angola, are on track to meet their emissions goals.

Unfortunately, fewer than 20 percent of countries have halted the approval of new fossil fuel projects, while over 80 percent lack transparent commitments to phase out fossil fuel subsidies. Furthermore, climate financing efforts are significantly lacking; over 80 percent of wealthy nations have not fulfilled their share of the USD 100 billion annual climate financing target, which is set to escalate to USD 300 billion at the upcoming COP29 summit in Baku.

In response to the increasing demand for transparent data, ASCOR has broadened its research efforts from an initial 25 countries to now encompass 70. Optimistically, about 40 countries have established legal frameworks to address climate challenges, and three-quarters possess strategies to manage physical climate risks.

The article discusses the shortcomings of wealthy countries in addressing climate change, particularly in relation to their emission reduction commitments and financial contributions to climate financing. The background focuses on the rising global temperatures and the urgency for decisive action as the world approaches critical temperature benchmarks. The economic implications are explored, especially concerning national debts and investor confidence in government debt. Additionally, the article emphasizes the legal actions being taken against governments that fail to protect their citizens from climate-related disasters and highlights the contrasting progress made by specific countries in mitigating climate change.

In summary, the findings from the ASCOR study underscore a troubling trend where affluent nations are not meeting their climate commitments, jeopardizing global efforts to mitigate climate change. The imminent risks associated with climate change demand not only urgent actions but also substantial financial contributions from wealthy countries, which remain disappointingly low. As the world approaches critical temperature thresholds, investors and policymakers must leverage robust strategies to foster accountability and drive substantial legislative action toward sustainability.

Original Source: www.outlookbusiness.com