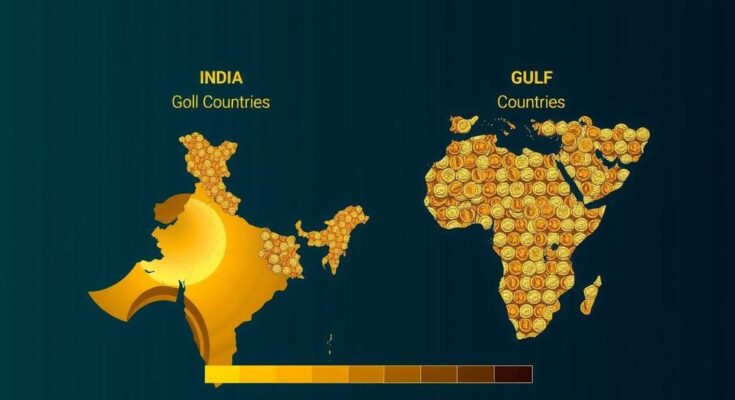

Gold prices in India are cheaper than in Oman, Singapore, UAE, and Qatar due to geopolitical tensions in the Middle East, particularly the Israel conflict. This scenario has driven up gold prices in those countries while India sees a price drop consistent with global trends, which recorded a sharp decline recently.

Recent reports indicate that gold prices in India are currently lower than those in Oman, Singapore, the United Arab Emirates, and Qatar. This trend may encourage consumers to purchase gold locally rather than at duty-free shops in the Middle East. The discrepancy in pricing is attributed to geopolitical tensions affecting the Middle East, particularly the ongoing conflict in Israel, which has led to an increase in demand for gold as a safe haven investment. Meanwhile, gold prices in India reflect a decline consistent with global trends, showcasing the most significant drop in three years with U.S. spot prices falling by 4.5% to approximately $2,563.25 per troy ounce.

The global gold market operates under various influences, including geopolitical events and investor behavior. In regions like the Middle East, heightened tensions often escalate the demand for gold as a protective financial asset. In contrast, fluctuations in the international gold market can result in price reductions in countries like India, where consumers may benefit from comparatively lower retail prices despite global market dynamics. Understanding these economic indicators is crucial for consumers looking to make informed purchasing decisions in precious metals.

In conclusion, the current landscape of gold prices favors buyers in India compared to those in several Middle Eastern nations. This pricing phenomenon is largely driven by geopolitical factors that elevate gold demand in those regions. As international prices experience volatility, India presents a more favorable market for consumers looking to invest in gold and precious jewelry. It is advisable for potential buyers to stay informed about the market trends to maximize their investment potential.

Original Source: www.livemint.com