With Donald Trump set to assume the presidency, financial markets are paying close attention to forthcoming policy changes. Optimism prevails following expectations of tax cuts and deregulation, although potential tariffs pose risks. The U.S. economy demonstrates considerable resilience, evidenced by projected GDP growth and corporate success for key players like Eaton and Caterpillar. Adopting a value-investing strategy is essential for long-term success in this evolving landscape.

With Donald Trump set to be inaugurated as the 47th President of the United States, financial markets are adjusting their outlook in anticipation of his administration’s policies. Historically, stock markets in the U.S. have displayed robust growth irrespective of political party control. Nonetheless, present investor sentiment is optimistic, largely hinging on expected tax reductions and deregulation, while potential tariffs and trade conflicts introduce an element of caution.

As we approach this new economic landscape, the financial sector has emerged as a frontrunner in performance due to expectations of decreased regulation. The U.S. economy is displaying resilience, with fourth-quarter GDP growth projected at 2.7% and healthy job creation figures. Companies such as Eaton PLC and Caterpillar are particularly well-positioned to thrive, supported by solid results linked to rising infrastructure expenditure and favorable regulations.

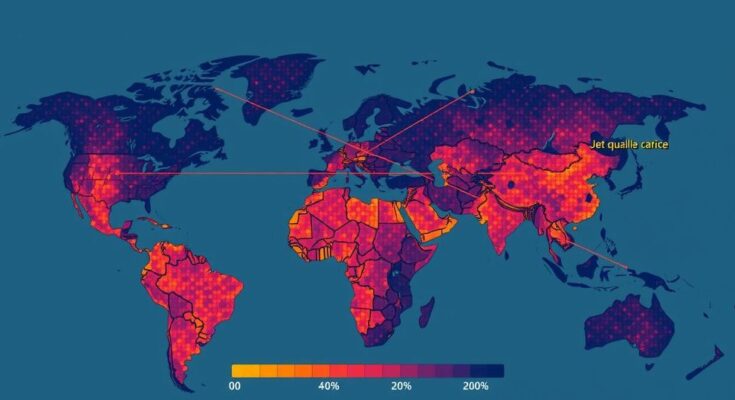

However, threats from tariffs and looming inflation cannot be overlooked. President-elect Trump’s proposal to impose a 25% tariff on imports from Mexico and Canada could disrupt supply chains and contribute to inflationary pressures. Although these tariffs may harm certain manufacturing sectors, they are potentially strategic maneuvers aimed at enhancing domestic production capabilities. Companies entrenched in the U.S. market might capitalize on these shifts, with seasoned leaders in firms like Eaton and Caterpillar likely adept at navigating such complexities.

To effectively maneuver through the evolving market dynamics post-election, investors ought to adopt a disciplined value-investing strategy. This involves selecting stocks with solid fundamentals, attractive valuations, and dependable dividends. Data has historically indicated that value stocks outperform during economic transitions. Warren Buffett aptly noted, “Long-term bets against America are seldom wise,” a viewpoint that remains pertinent in the current landscape.

The upcoming election heralds a new economic chapter, brimming with challenges and opportunities alike. By prioritizing diversification and maintaining a long-term outlook, investors can adeptly respond to the changing market conditions. The key is to remain focused, disciplined, and committed to one’s investment approach.

The upcoming inauguration of Donald Trump as the 47th President of the United States signifies a potential shift in economic policies, prompting market participants to reassess their investment strategies. Historically, the performance of U.S. stock markets has been resilient across different administrations, but expectations surrounding policy changes can significantly influence investor sentiment. Anticipated measures such as tax cuts and deregulation are fostering optimism, while proposals for tariffs present risks that could impact corporate profitability and overall market performance. Understanding these dynamics is essential for navigating the financial landscape effectively during this transitional period.

In conclusion, as Donald Trump prepares to take office, a pivotal economic era is unfolding, characterized by both potential opportunities and significant risks. The financial markets are likely to remain volatile and influenced by the administration’s moves, particularly regarding regulation and trade policies. Investors are encouraged to employ a disciplined, value-oriented investment approach to secure long-term success amidst these changing dynamics. Staying informed and adaptable will be crucial in capitalizing on the emerging trends in the post-election market environment.

Original Source: www.forbes.com