Weather-induced complications in West Africa and Vietnam are driving cocoa and coffee prices higher. Cocoa futures rose due to dry conditions in the Ivory Coast, while Vietnam’s rainfall issues led to a decline in coffee exports and increased prices. The overall market reflects significant supply chain concerns, necessitating close monitoring by investors.

Recent adverse weather conditions in West Africa and Vietnam have led to a significant increase in cocoa and coffee prices, prompting investor concerns regarding supply chain stability in these vital agricultural regions. Specifically, dry weather in the Ivory Coast has driven New York cocoa futures up by 3.8% to $11,660 per metric ton, nearing record highs from the previous year. Additionally, while arrivals of cocoa in Ivory Coast ports increased to 1.109 million tons, supply inconsistencies remain prevalent. Meanwhile, Robusta coffee prices climbed by 1.45% to $5,040 per ton due to Vietnam facing rainfall challenges that impacted harvests and resulted in a 17.2% reduction in exports. Arabica coffee also saw a rise of 2.2%, demonstrating parallel supply concerns. Contrarily, sugar markets exhibited mixed outcomes, with raw sugar futures rising slightly by 0.05% but March white sugar futures decreasing by 0.1%.

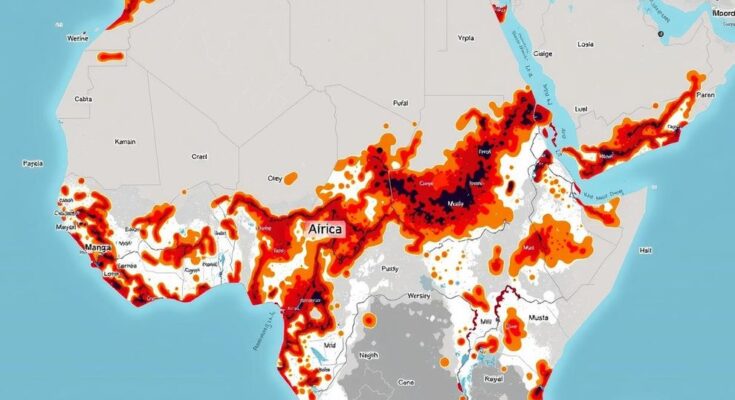

The rise in commodity prices, particularly cocoa and coffee, is largely attributed to weather-related disruptions in key producing areas such as West Africa and Vietnam. The Cocoa and Coffee sectors are particularly sensitive to climate fluctuations, which can severely affect crop yields and overall supply volumes. Increasingly erratic weather patterns, likely associated with climate change, exacerbate these challenges, making agricultural yield more unpredictable. This scenario amplifies the importance of developing resilient agricultural practices and supply chain strategies to cope with climate variability.

In summary, the fluctuations in cocoa, coffee, and sugar prices prompted by recent weather disturbances in West Africa and Vietnam underscore the fragile nature of global supply chains in agriculture. It is essential for investors to remain vigilant regarding these developments and the broader economic implications they entail. As weather-related challenges continue to emerge, the necessity for improved resiliency and adaptability within agricultural sectors has become increasingly apparent, influencing both market dynamics and trade relations.

Original Source: finimize.com