The Democratic Republic of Congo and Kenya are deemed the riskiest investment destinations in East Africa, as per the Africa Risk-Reward Index 2024, due to political, social, and economic threats. The DRC scored 7.6 and Kenya 6.06 on the risk scale. In contrast, Rwanda is noted as the safest with a score of 5.11. The report indicates deteriorating risk and reward scores for both DRC and Kenya, affected by ongoing violence and economic instability, respectively.

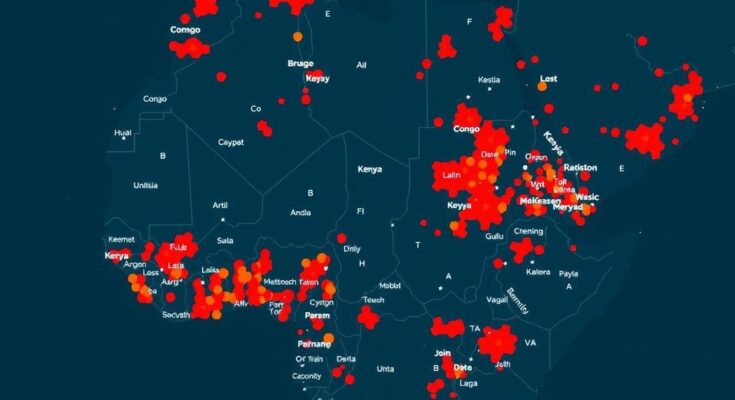

The Democratic Republic of Congo (DRC) and Kenya are identified as the most hazardous investment locations in East Africa, primarily due to prevailing political, social, and economic uncertainties. The recently released Africa Risk-Reward Index 2024 by Control Risks and Oxford Economics Africa highlights this trend, assigning a risk score of 7.6 out of 10 to the DRC and a score of 6.06 to Kenya for the period ending September 30, 2024. In contrast, Rwanda emerges as the safest investment option in the region with a risk score of 5.11. The risk scores assigned to each nation derive from extensive evaluations of economic and political threats assessed on a scale where 10 indicates the highest risk. Furthermore, the reward scores reflect medium-term economic growth forecasts, economic scale, structure, and demographics, with growth forecast receiving the most weight. This is premised on the notion that greater economic growth correlates with improved investment opportunities. The report indicates a deterioration in Kenya’s reward score, which fell by 0.08 to 5.25 as of September 2024, compared to 5.33 in the previous year. Similarly, its risk score increased by 0.26 to 6.06 from 5.8 during the same timeframe, thereby resulting in an overall risk-reward score drop of 0.34. Concurrently, the DRC saw its reward score decline by 0.23 to 5.65, alongside a slight increase in its risk score to 7.6 from 7.53, leading to an overall reduction in the risk-reward score by 0.3. In August, global rating agency S&P Global downgraded Kenya’s credit rating, attributing this decision to the withdrawal of the controversial Finance Bill 2024, following negative responses to the proposed tax changes amid increasing national debt concerns. This downgrade marked the third such action, following similar moves by Fitch and Moody’s investors. The report highlights continuing anti-government sentiments in Kenya, fueled by protests related to the Finance Bill 2024, which saw significant public backlash that resulted in the bill’s withdrawal and adjustments to opposition representation in government roles by President William Ruto. The document articulates that, “The government’s tax push was viewed as a betrayal of Ruto’s election pledge to improve the lives of ordinary citizens, high inflation and a weakening currency had in fact had the opposite effect.” In the DRC, escalating violence, particularly in the eastern regions, has exacerbated a severe humanitarian crisis, causing an upsurge in the number of displaced individuals seeking refuge in overflowing camps where basic needs remain unmet. The Congolese armed forces are engaged in a conflict with the M23 group, which has steadily gained territorial control since 2022. Overall, the investment landscape in East Africa remains precarious, with looming risks affecting potential returns. The report’s findings underscore the critical need for investors to carefully assess political and economic conditions before making commitments.

The Africa Risk-Reward Index serves as a comprehensive country risk ranking tool, evaluating the investment climate across African nations based on political, economic, and social factors. The index factors in both the risks associated with a given country and the potential rewards from investing there, thus allowing investors to make well-informed decisions. The most recent index highlights East Africa’s challenging investment environment, particularly for the DRC and Kenya, while showcasing Rwanda as a more stable option amidst widespread issues in the region.

The report conclusively highlights the significant risks associated with investing in both the Democratic Republic of Congo and Kenya, with scores suggesting deteriorating conditions in both political and economic spheres. While Rwanda stands out as a safer alternative, continued unrest and violence in the DRC, coupled with fiscal mismanagement in Kenya, raise pivotal concerns for potential investors in East Africa. Investors are encouraged to remain vigilant and consider these factors when evaluating investment opportunities in the region.

Original Source: www.theeastafrican.co.ke