This week in Africa’s cryptocurrency landscape saw Nigeria easing its stance on Binance, Kenya advancing tax compliance measures for crypto holders, and Ethiopia solidifying its leadership in Bitcoin mining amid emerging challenges in user engagement and cybersecurity risks.

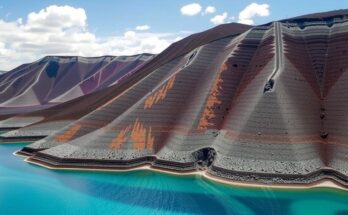

Africa is witnessing significant movements in the cryptocurrency sector, with developments in Nigeria, Kenya, and Ethiopia leading the charge. In Nigeria, the release of Binance executive Tigran Gambaryan from legal troubles indicates a potential thawing in the country’s previously stringent stance towards cryptocurrency exchanges. This shift is accompanied by Nigeria’s preparation for a regulatory framework aimed at enhancing tax compliance among crypto organizations, recognizing its position as a second globally ranked nation in crypto adoption, according to a recent Chainalysis report. Moving to Kenya, the Kenya Revenue Authority (KRA) is intensifying efforts to monitor and tax cryptocurrency activity, with plans for the implementation of a tracking system for crypto transactions. This includes enforcing a 3% tax on crypto earnings, intended to broaden the national tax base. In South Africa, the South African Revenue Service (SARS) is poised to similarly enhance its scrutiny of crypto income declarations, as many of the country’s estimated 5.8 million crypto holders remain unreported in their tax filings. Meanwhile, Ethiopia is solidifying its lead in Bitcoin mining as the Bitcoin mining firm, BitFuFu, announces plans to acquire a greater stake in a local mining operation. This initiative is expected to leverage Ethiopia’s cost-effective renewable energy resources, significantly reducing operational expenses. However, the landscape for crypto gaming in the region encounters turbulence, with dissatisfaction among youth participating in tap-to-earn games like Hamster Kombat, leading to a declining player base following initial hype. Finally, a cautionary note was raised regarding the crypto sector’s vulnerability to financial fraud. The presence of the Grandoreiro Trojan malware, which targets financial platforms across several African nations, necessitates heightened security measures for crypto entities to safeguard user assets.

The recent movements in the African cryptocurrency landscape reflect the regional governments’ increasingly proactive approaches towards regulation, taxation, and operational frameworks for crypto-related activities. Nigeria’s release of Binance’s Tigran Gambaryan underscores a pivot from strict regulatory practices to a more open and compliant ecosystem, potentially paving the way for renewed investment and growth in the crypto sector. In Kenya, ongoing assessments to implement real-time tracking of crypto transactions align with global trends, as nations begin to formalize tax regulations for cryptocurrency earnings. South Africa’s initiative mirrors this effort, aiming to enhance transparency and compliance amongst the vast crypto holdings present in the country. Ethiopia’s emergence as a leader in Bitcoin mining is attributed to its abundant renewable energy resources, which create a favorable environment for mining operations, inviting further investments. However, the challenges faced by crypto gaming permeate the youth demographic, indicating a need for more sustainable engagement strategies within the niche.

In summary, Africa’s crypto landscape is evolving, with Nigeria indicating a more welcoming approach towards cryptocurrency operations, Kenya implementing stringent tax measures, and Ethiopia reinforcing its position as a mining powerhouse. These developments signal a significant transformation in the perception and regulation of cryptocurrencies across the continent, though concerns regarding fraud and user satisfaction remain pressing issues. The focus on compliance and regulation may pave the way for a more robust and secure crypto economy in Africa as stakeholders adapt to these changes.

Original Source: 99bitcoins.com